Market Sentiment and Macro Backdrop

Global markets show clear risk-avoidance behavior. Investors worry about economic uncertainty. Defensive assets gain popularity for stable returns.

Oil markets face short-term demand weakness. OPEC+ supply increases add pressure. Brent crude trades near $70-$85 range lows.

Clean tech struggles with rising financing costs. Residential solar suffers most.

Power demand expectations split. AI data centers develop slower than hoped. FERC policy uncertainty weighs on confidence.

Sector Analysis & Stock Picks

1. Midstream Energy: Focus on Quality Assets

Midstream energy shifts from defensive to high-beta plays. AI power demand links it closer to tech stocks. Gas fundamentals stay strong despite LNG project risks.

Kinder Morgan (KMI)

- Owns critical gas pipelines and fuel networks

- Targets $31 price (12x 2026 EBITDA)

- Current price: $26.14

2. Oil Majors: Strong Balance Sheets Win

Companies with solid cash flow and dividends outperform.

Chevron (CVX)

- 10% net debt-to-cap ratio

- 4.4% dividend yield

- Targets $183 (8x EV/DACF)

- Current price: $152.95

3. E&P Firms: Hedge Volatility

Companies using cash discipline and price hedging work best.

Extend Energy (X)

- Operates in multiple basins

- Targets $121 (8x 2026 FCF)

- Current price: $96.03

4. Clean Tech: Utility Solar Shines

Residential solar weakens but utility projects grow.

Nextracker (NXT)

- Leads 2025 project bookings

- Targets $61 (15x forward P/E)

- Current price: $42.09

5. Utilities: Grid Upgrades Matter

Power companies benefit from transmission investments.

Southern Co (SO)

- Expanding Georgia power grid

- Targets $100 (21x P/E)

- Current price: $88.74

6. Energy Services: Clear Backlogs Help

Policy risks exist but order visibility supports profits.

TechnipFMC (FTI)

- Growing subsea orders

- Targets $36 (6.5x EV/EBITDA)

- Current price: $26.31

7. Metals: Trade Policy Plays

Industry leaders adapt to tariffs and costs.

Nucor (NUE)

- Controls full production cycle

- Targets $177 (8.8x EBITDA)

- Current price: $131.99

Key Market Data Check

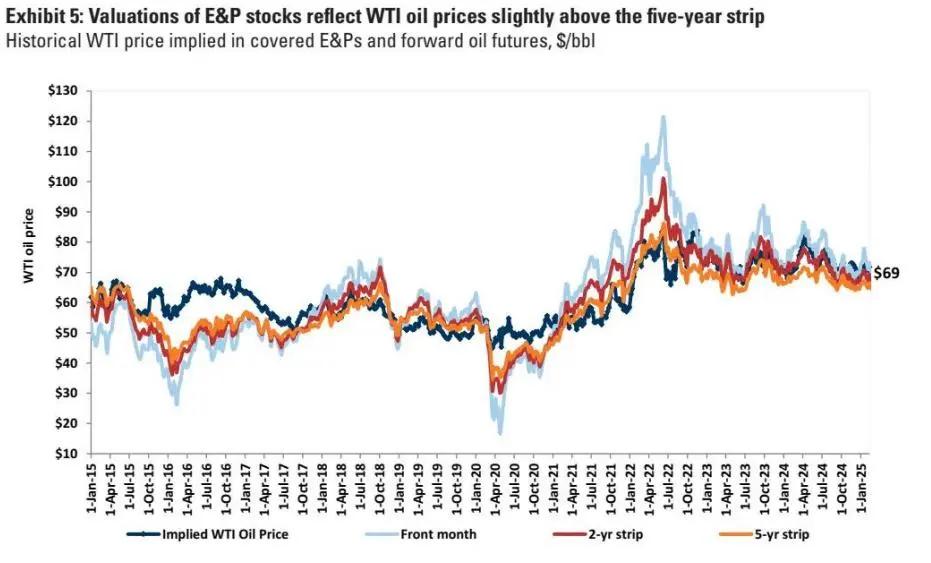

Oil Outlook

E&P stocks imply $90/bbl WTI price. This beats 5-year futures.

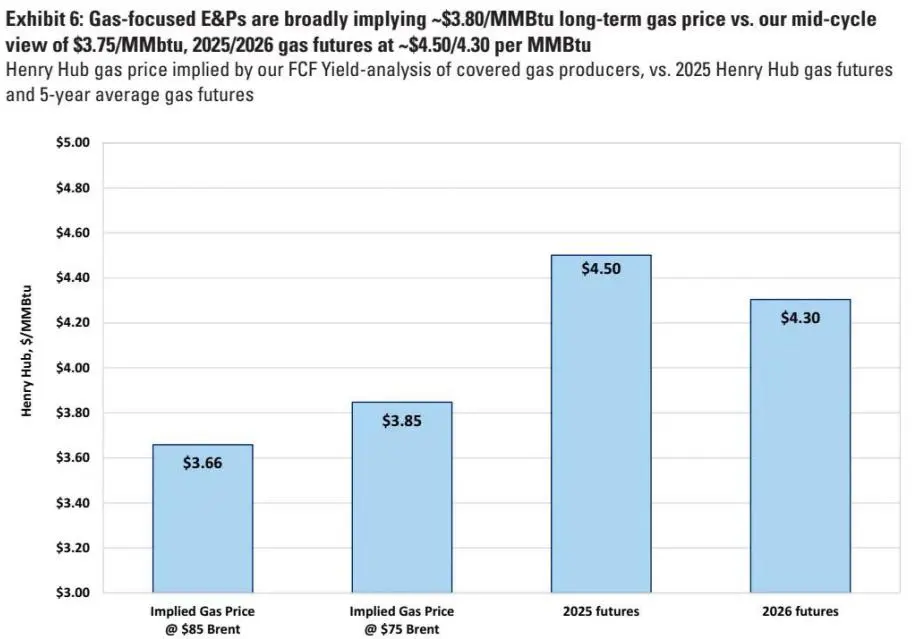

Natural Gas Pricing

Gas stocks suggest $3.80/mmBtu long-term price. Matches Goldman’s $3.75 forecast.

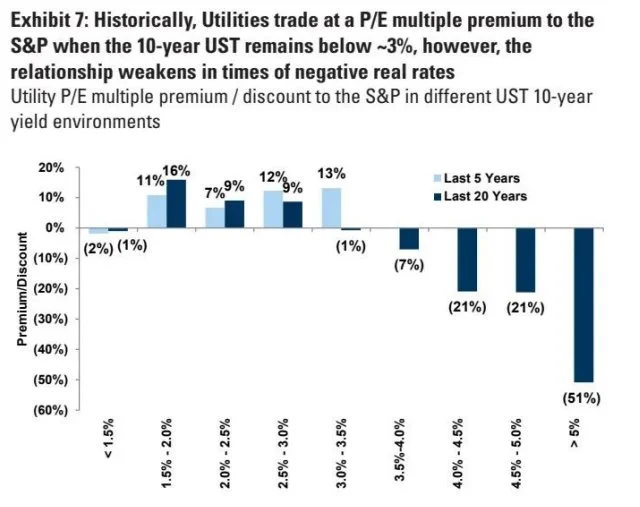

Utility Valuations

Utilities trade at premium P/E when 10-year yields fall below 3%.